All Categories

Featured

Table of Contents

- – Tailored Accredited Investor Wealth-building O...

- – High-Quality Accredited Investor Funding Oppor...

- – Innovative Exclusive Investment Platforms For...

- – First-Class Accredited Investor Syndication D...

- – High-Quality Accredited Investor Investment ...

- – Recommended Accredited Investor Investment F...

It's vital to understand that attaining recognized financier status is not a single achievement. It's consequently essential for recognized capitalists to be proactive in checking their economic circumstance and updating their records as needed.

Failing to satisfy the recurring criteria may result in the loss of accredited financier status and the connected benefits and opportunities. While many of the financial investment types for Accredited Capitalists coincide as those for any person else, the specifics of these financial investments are usually different. Private positionings describe the sale of securities to a choose group of certified investors, commonly beyond the general public market.

Exclusive equity funds pool resources from accredited capitalists to get ownership stakes in firms, with the goal of boosting efficiency and generating substantial returns upon exit, typically with a sale or first public offering (IPO).

Market changes, residential or commercial property management challenges, and the prospective illiquidity of realty assets must be meticulously evaluated. The Securities and Exchange Commission (SEC) plays a crucial role in regulating the activities of accredited capitalists, that need to stick to especially outlined rules and coverage requirements. The SEC is in charge of enforcing securities regulations and laws to shield investors and keep the honesty of the monetary markets.

Tailored Accredited Investor Wealth-building Opportunities

Policy D provides exceptions from the enrollment needs for sure personal positionings and offerings. Approved capitalists can participate in these exempt offerings, which are normally included a minimal number of sophisticated capitalists. To do so, they must offer accurate details to providers, complete necessary filings, and comply with the regulations that control the offering.

Conformity with AML and KYC requirements is necessary to preserve standing and gain accessibility to numerous investment chances. Stopping working to follow these regulations can result in serious penalties, reputational damages, and the loss of accreditation benefits. Let's unmask some typical mistaken beliefs: A typical false impression is that recognized financiers have an assured benefit in terms of financial investment returns.

High-Quality Accredited Investor Funding Opportunities

Yes, certified financiers can lose their condition if they no more satisfy the qualification requirements. If a certified financier's earnings or internet well worth falls below the assigned thresholds, they might shed their accreditation. It's crucial for certified investors to routinely evaluate their financial scenario and report any kind of modifications to make sure compliance with the policies

It depends on the certain investment offering and the laws regulating it. Some financial investment chances may permit non-accredited investors to get involved with certain exceptions or provisions. It is necessary for non-accredited financiers to very carefully examine the terms and problems of each investment chance to identify their eligibility. Bear in mind, being an approved investor includes benefits and duties.

Innovative Exclusive Investment Platforms For Accredited Investors

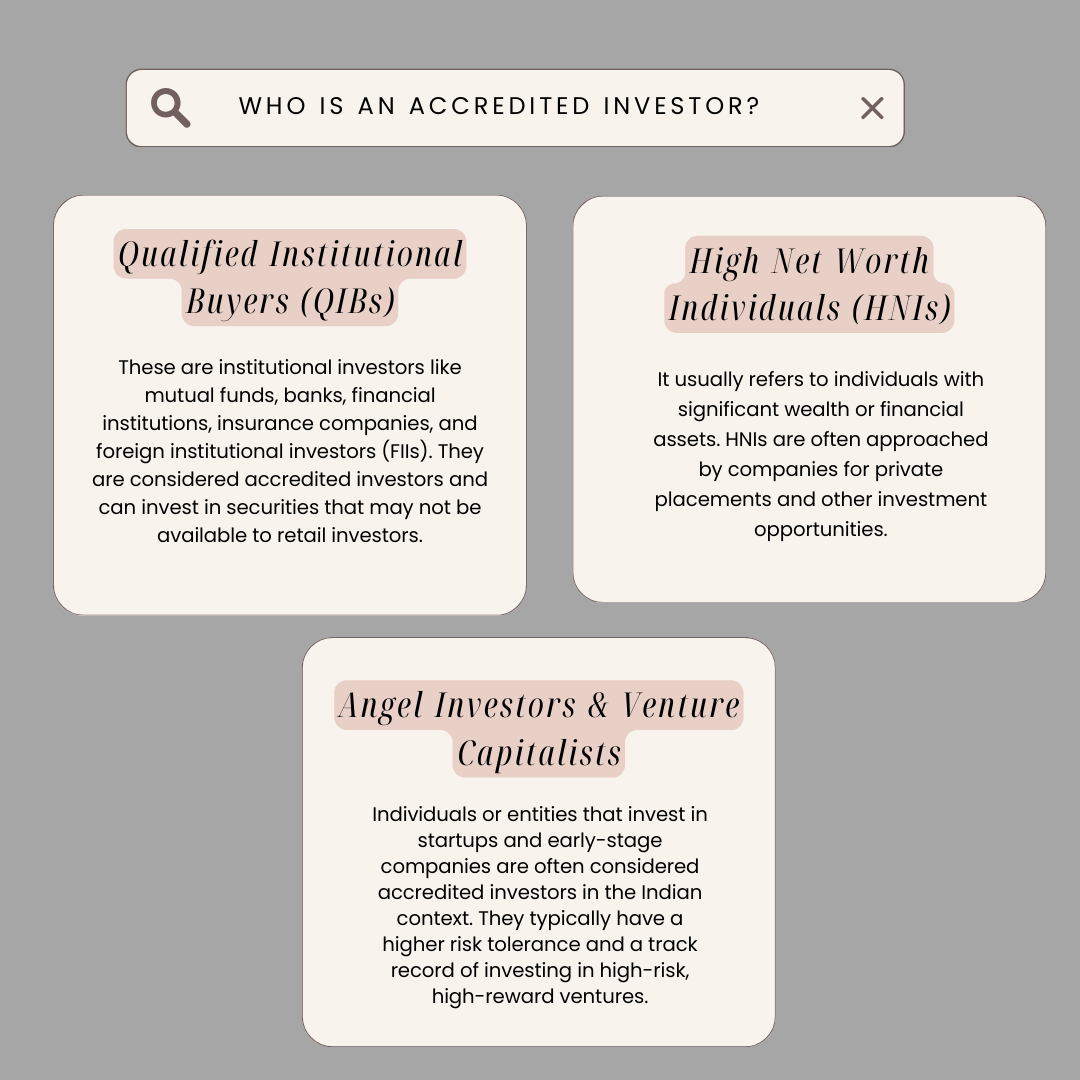

If you desire to invest in certain complicated investments, the Securities and Exchange Compensation (SEC) needs that you be a certified investor. To be accredited, you need to satisfy particular demands regarding your wealth and earnings in addition to your investment expertise. Have a look at the basic demands and advantages of becoming a certified investor.

The SEC takes into consideration that, since of their monetary security and/or investment experience, certified financiers have much less requirement for the protection offered by the disclosures required of controlled financial investments. The guidelines for certification, which have actually been in place since the Stocks Act of 1933 was developed as a feedback to the Great Clinical depression, can be discovered in Law D, Regulation 501 of that Act.

First-Class Accredited Investor Syndication Deals for High Returns

However, that company can not have actually been developed simply to purchase the unregistered securities in question. These requirements of revenue, total assets, or specialist experience make certain that inexperienced investors do not take the chance of money they can not afford to lose and do not take economic threats with financial investments they don't understand. No real accreditation is readily available to verify your standing as a recognized capitalist.

Neither the SEC neither any other governing agency is associated with the procedure. When you look for accredited financier status, you're most likely to undertake a screening process. You may need to fill in an initial set of questions asking concerning your financial investment history, earnings, and total assets. Records you will most likely need to generate might include: W-2s, income tax return, and various other documents confirming earnings over the past two years Monetary declarations and bank declarations to validate net worth Debt reports Paperwork that you hold a FINRA Series 7, 64 or 82 designation Paperwork that you are a "experienced employee" of the entity releasing the protections The capacity to spend as a "knowledgeable worker" of a fund issuing safeties or as an economic professional holding a suitable FINRA permit is new as of 2020, when the SEC increased its definition of and certifications for certified financiers.

High-Quality Accredited Investor Investment Opportunities for Accredited Investors

These protections are unregistered and uncontrolled, so they do not have offered the governing securities of authorized protections. As a whole, these financial investments may be particularly volatile or lug with them the potential for substantial losses. They include different structured financial investments, hedge fund financial investments, personal equity investments, and various other personal placements, all of which are uncontrolled and might lug considerable danger.

Naturally, these financial investments are also appealing due to the fact that in addition to added threat, they carry with them the possibility for considerable gains, usually higher than those offered using ordinary financial investments. Approved capitalists have available to them financial investments that aren't available to the public. These financial investments include personal equity funds, angel investments, specialty investments such as in hedge funds, equity crowdfunding, property investment funds, endeavor resources investments, and straight financial investments in oil and gas.

Firms providing non listed safety and securities just have to supply paperwork concerning the offering itself plus the location and police officers of the business offering the safety and securities (venture capital for accredited investors). No application process is called for (as is the instance with public stock, bonds, and shared funds), and any due diligence or extra info offered depends on the firm

Recommended Accredited Investor Investment Funds

This details is not intended to be individual recommendations. Possible participants need to seek advice from with their personal tax obligation professional pertaining to the applicability and result of any type of and all benefits for their very own individual tax situation. In addition, tax legislations change every now and then and there is no assurance pertaining to the analysis of any type of tax laws.

Accredited financiers (occasionally called professional financiers) have accessibility to financial investments that aren't offered to the public. These financial investments might be hedge funds, difficult cash lendings, exchangeable financial investments, or any various other security that isn't signed up with the economic authorities. In this write-up, we're going to focus particularly on property investment choices for certified investors.

Table of Contents

- – Tailored Accredited Investor Wealth-building O...

- – High-Quality Accredited Investor Funding Oppor...

- – Innovative Exclusive Investment Platforms For...

- – First-Class Accredited Investor Syndication D...

- – High-Quality Accredited Investor Investment ...

- – Recommended Accredited Investor Investment F...

Latest Posts

Texas Tax Lien Investing

Buying Tax Foreclosed Properties

Us Tax Liens Investing

More

Latest Posts

Texas Tax Lien Investing

Buying Tax Foreclosed Properties

Us Tax Liens Investing